Gift of Knowledge : Unwrapping The potential of Gift Nifty

Gift of Knowledge : Unwrapping The potential of Gift Nifty Revolutionizing the world of trading, GIFT Nifty has emerged

BankNifty is a leading indicator of the health and performance of the financial services industry. It includes a diverse range of banking stocks, including both public and private sector banks, giving a comprehensive view of the dynamics of the sector. In addition, BankNifty is widely used by investors, traders and analysts for derivatives trading, hedging strategies and sector analysis due to its high liquidity and broad representation of the banking industry. The index is closely monitored by market participants for insights into economic trends, monetary policy implications and regulatory changes affecting the banking sector

BankNifty futures contracts allow traders to speculate on the future direction of the index, either by taking long positions (expecting prices to rise) or short positions (anticipating price declines). These futures contracts are standardized agreements to buy or sell BankNifty at a predetermined price on a future date.

BankNifty options provide traders with the right, but not the obligation, to buy (call option) or sell (put option) BankNifty at a specified price (strike price) within a set period (until expiration). Options trading allows for various strategies, such as hedging, speculation, andincome generation, depending on market conditions and trader objectives.

New traders come to trade in BankNifty option because BankNifty option is faster than nifty option and gives very big move due to big move banknifty option is popular in treding due to aggressive move of BankNifty 90% option buyer loses money option buying.The main reason for loss in trading is time decay

For those interested in delving deeper into the world of coding and how it intersects with financial analysis, we’ve compiled detailed insights and strategies in our coding blog

Exploring Banknifty Movement A Data Analisys

. Discover how to harness the power of programming languages like Python to automate trading strategies, analyze market data, and unlock hidden patterns in BankNifty movements. Whether you’re a novice or an experienced coder, our blog provides valuable resources and tutorials to help you enhance your trading skills and make informed decisions in the dynamic world of finance.

Think of the decay of time like an ice cube melting in the sun. When you buy an option, its value begins to melt over time, like an ice cube slowly disappearing. Time decay, also known as theta decay, is the gradual decline in the value of an option as it approaches its expiration date. So, the longer you hold the option, the more its value shrinks, just like an ice cube shrinks the longer it sits in the sun. That’s why it’s important for option buyers to watch out for time decay, as it can eat away at their investment if they hold the option for too long.

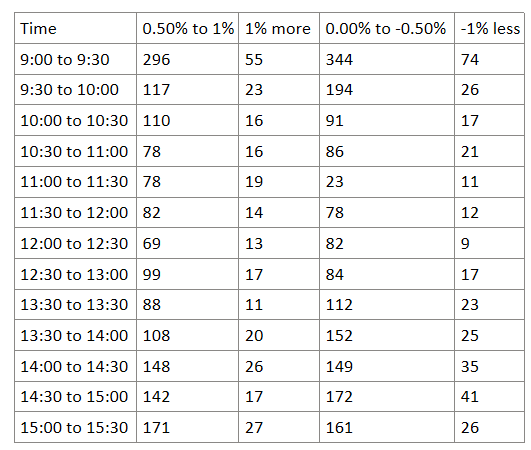

If you want to succeed in option buying, timing is crucial. In this blog, we will study BankNifty historical data from 2010 to 2020, analyzing 30-minute intervals between 9:00 to 15:00. We will identify the two most favorable 30-minute periods for buying options and discuss them in detail. Feel free to share any suggestions or ideas you have!”

Below, we’ve segmented the data into 30-minute intervals, analyzing it between 9:00 and 15:00. Take a close look to gather insights and valuable information. Additionally, consider comparing the data across different time periods or incorporating technical indicators to further refine your analysis. Don’t hesitate to reach out if you need assistance or have any questions along the way!

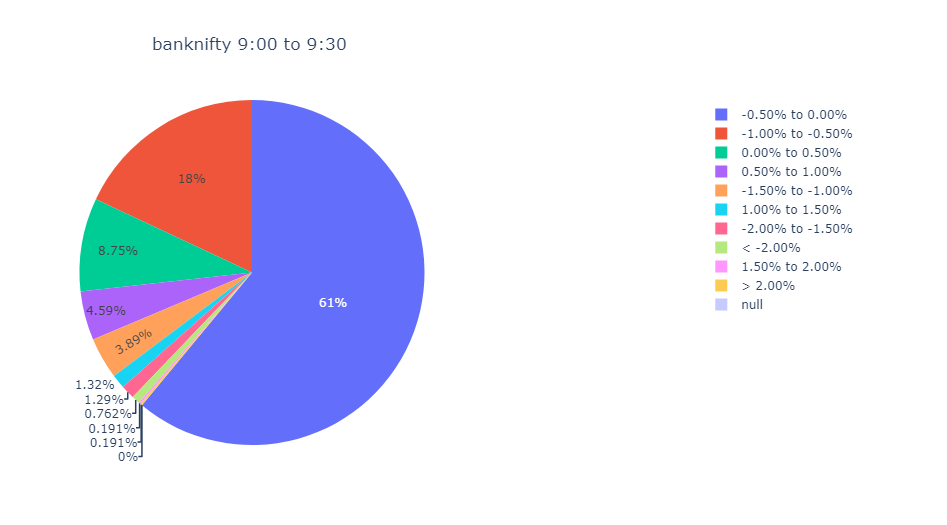

During the 9:00 to 9:30 interval, the market opens, marking a crucial time for traders. The initial 5 minutes are particularly active, with rapid price movements often influenced by overnight news and events. To capitalize on potential opportunities during this period, consider closely monitoring market sentiment and reacting swiftly to emerging trends. Additionally, employing pre-market analysis and setting up trade plans beforehand can help navigate the volatile opening period more effectively.

Based on the analysis of over 2500 days of BankNifty data, it’s observed that BankNifty tends to make a move between 0.00% to -0.50% approximately 61% of the time during the first 30 minutes of trading. This suggests that the majority of the time, BankNifty exhibits a negative movement during the initial trading period.

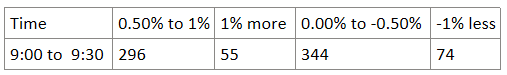

During the 9:00 to 9:30 timeframe, BankNifty exhibited movements within the range of 0.50% to 1% on 296 occasions. Additionally, there were 55 instances where BankNifty moved more than 1% during this period. Conversely, BankNifty experienced 344 moves less than -0.50% to -1%, with 74 occurrences where the movement was less than -1%.

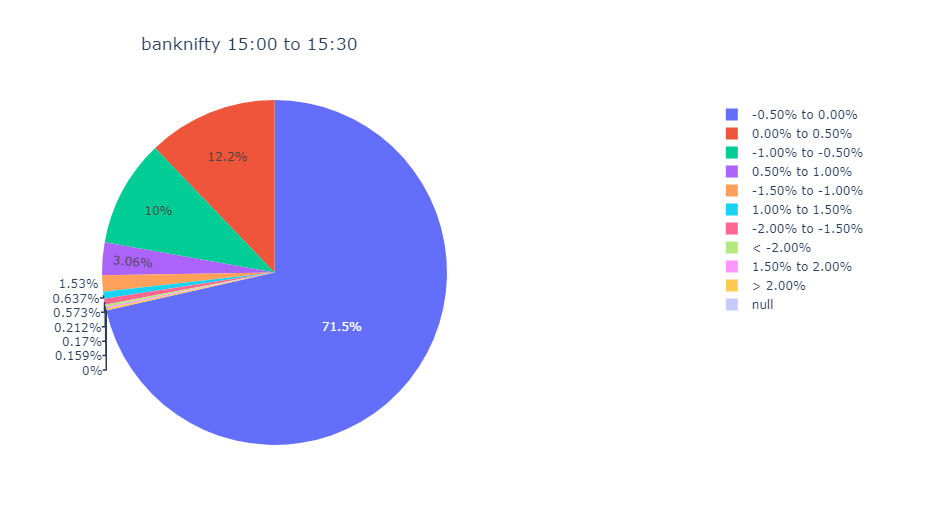

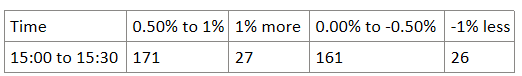

The period from 15:00 to 15:30 marks the market closing time, with intraday positions typically being squared off between 14:55 and 15:00. This timeframe often sees heightened volatility, as traders rush to finalize their positions before the market closes. It’s crucial for traders to remain vigilant during this period, as sudden moves in BankNifty can occur, potentially impacting open positions.

To navigate this volatile period effectively, traders may consider implementing risk management strategies such as trailing stop-loss orders to protect profits and limit potential losses. Additionally, staying updated on market developments and news events that could influence BankNifty’s movement can help in making informed trading decisions.

BankNifty moves downward approximately 71% of the time within the range of 0% to -0.50% during the 30-minute period from 15:00 to 15:30. Additionally, it experiences upside moves of 2% or more about 1.53% of the time during this timeframe.

Analyzing the data further, during the 15:00 to 15:30 interval, BankNifty recorded 171 instances of moves greater than 0.50%, 27 instances of moves greater than 1%, 161 instances of moves less than -0.50%, and 26 instances of moves less than -1%.

Based on this analysis, it appears that the period from 15:00 to 15:30 presents favorable conditions for option buying, as BankNifty tends to exhibit rapid movements within a short span of time.

Analyzing the data further, during the 15:00 to 15:30 interval, BankNifty recorded 171 instances of moves greater than 0.50%, 27 instances of moves greater than 1%, 161 instances of moves less than -0.50%, and 26 instances of moves less than -1%.

Based on this analysis, it appears that the period from 15:00 to 15:30 presents favorable conditions for option buying, as BankNifty tends to exhibit rapid movements within a short span of time.

Disclaimer:

The content provided on this blog is for educational and informational purposes only. It is not intended to be investment advice or a solicitation to buy or sell any financial instrument. The author(s) of this blog are not registered financial advisors or SEBI registered analysts. Trading and investing in financial markets involves risk. Readers are solely responsible for their own investment decisions and should seek the advice of a qualified financial professional before making any investment. The author(s) of this blog shall not be held liable for any losses incurred from the use of information presented herein.”

Gift of Knowledge : Unwrapping The potential of Gift Nifty Revolutionizing the world of trading, GIFT Nifty has emerged

Exploring BankNifty Movements: A Data Analysis Welcome to our exploration of BankNifty movements using data analysis techniques! In this